TLDR:

-

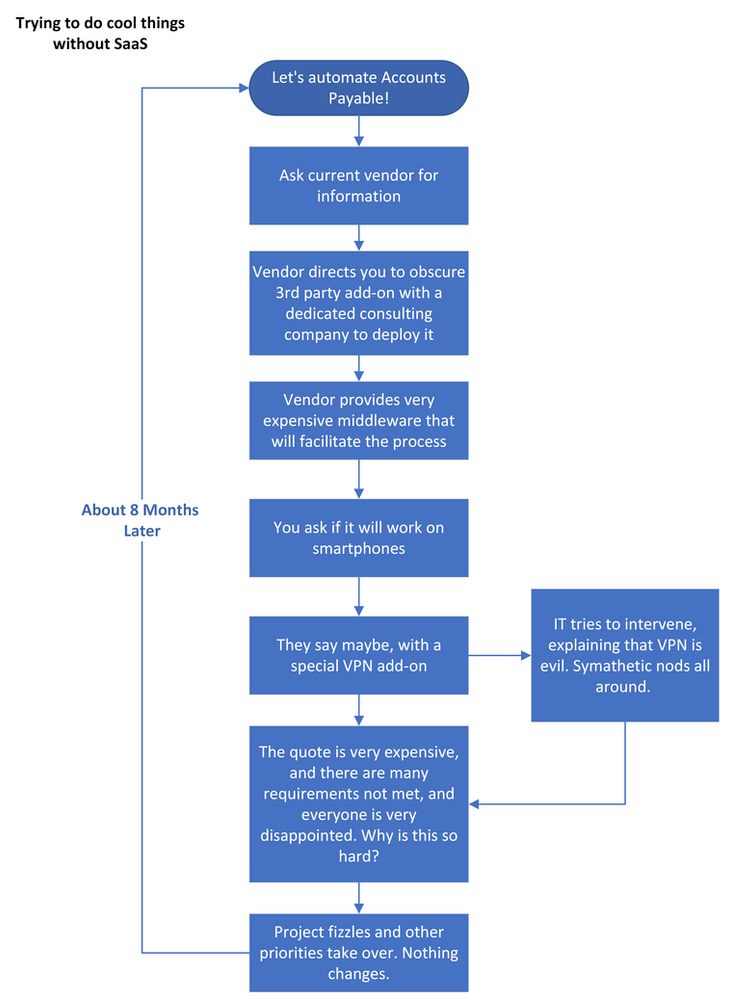

- Legacy apps lack integration options and contain hidden cost and risk

-

- Accounting apps are often the last to migrate and may hold back overall modernization

-

- Software as a Service (SaaS) provides easier opportunities to implement meaningful improvement such as electronic expense claims and AP automation.

-

- We are able to help you migrate to a modern platform

Accountants are some of the unsung heroes of businesses and nonprofits. In fact, I’d like to give a special shoutout to the nonprofit accountants tracking dozens of funders. I’ve been there, and it’s special experience reporting monthly, quarterly, annually to 20+ funders. We appreciate the funds though, of course! Those who know, know. However, that’s not quite what I’m here to talk about.

One of the last hold-outs of modernization is often the Accounting platform. What we see is that the systems around them move to cloud and Software as a Service (SaaS), including HR systems, however finance remains where it is. You might move from a physical server to a “hosted” solution, which is really just a traditional server in someone else’s closet, carrying the same limitations.

Adopt Software as a Service (SaaS) = Eliminate Complexity

When we talk about line of business apps such as for Accounting, to modernize is to move to a SaaS platform. SaaS removes many of the layers of the system that are traditionally hard to manage, and those are:

-

- Physical servers

-

- Operating systems

-

- Updates

-

- Connectivity (i.e. usually VPN… one of the arch enemies of IT everyone)

-

- Backups

That list is expensive to maintain, and usually isn’t done very well. It’s not done very well, because it’s expensive. See how that works?

Join the Herd

In technology systems, scale is where it’s at. Create one application, and share it among as many users as you can. I like the gym analogy to explain this: Consider what you could build in your basement, compared to subscribing to your local mega gym. You share the costs among all the members and get more for less. Soooo, the mega gym is the cloud in this analogy.

There’s more though, and this is where it gets interesting. Once a platform has enough users, it becomes attractive for 3rd party companies to develop applications to integrate with it. With the accounting app in the cloud, they only need to build one integration, which makes it more cost effective, because, once again, you are effectively sharing the cost of the integration as well!

The Point!

If your Accounting platform is a fully SaaS-based platform, you will have far more opportunity to streamline your work in meaningful ways, and very likely spend less overall. Such things as the following become relatively easy:

-

- Accounts Payable Automation

-

- Easier bank integrations

-

- Electronic payments

-

- Emailing invoices and automated statements and reminders

-

- Mobile app access

-

- Electronic expense claims and time sheets

-

- Remote collaboration with your Accountants and Bookkeepers

-

- Advanced Cash Flow Management with integrated apps built for this purpose

-

- Integration with modern Dashboards for advanced analytics

When that first employee submits an expense claim by snapping a photo with their phone, you are going to be the Hero of the Day. That’ll be fun.

Let’s do it!

Let us work together to destroy paper forms, email-based “electronic” workflows, spreadsheets and filing cabinets! If you’re ready, we’d love to help!